Rise of fintech challenges banking industry

Technology tops location, location, location as U.S. banking customers’ priorities shift.

Study by the USC Annenberg Center for the Digital Future finds large percentage of Americans willing to move their money to companies with no experience in financial services.

Contact: Eddie North-Hager at (213) 740-9335 or edwardnh@usc.edu; Harlan Lebo at (310) 871-4744 or hjlebo@gmail.com

Would Americans consider putting their money in an “Amazon Bank” or “Google Financial Services?”

More than half said yes.

Nearly 60 percent of American banking customers would consider moving their money to accounts offered by familiar companies, such as online retailers, search engines, or big-box stores, even though they have no experience with financial services, according to a new study conducted by theCenter for the Digital Future at USC Annenberg.

The study found that if their deposits had the same guarantees as traditional banks, Americans who would consider a non-traditional banking company as possible financial partners cited Amazon, Google, and Walmart, among others.

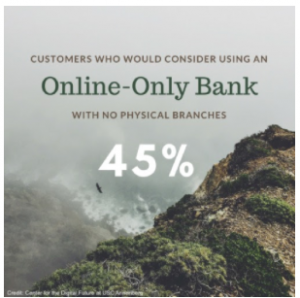

The Center for the Digital Future’s study creates a portrait of Americans with contrasting views about their banking — 82 percent of customers who are satisfied with their current banks but 46 percent of them would readily switch to another institution; and 55 percent who currently visit their brick-and-mortar branch in person at least monthly while 43 percent said they are likely to switch to exclusive online banking.

“We strongly believe banking is the next industry to be completely disrupted by digital change,” said Jeffrey I Cole, director of the Center for the Digital Future at USC Annenberg. “Our research shows customers are far ahead of the banks in looking to the web and apps as their preferred banking methods.

“Banks are ill-prepared,” said Cole, “for the massive changes about to be brought by the entry of Amazon, Google and new fintech companies into their businesses.”

Download the full report at digitalcenter.org/fom

All images courtesy of Center for the Digital Future at USC Annenberg, Future of Money and Banking Study. Graphic by Michelle Veriah

- Cashless society — 32 percent of respondents said that because of digital technology, they won’t need cash anymore